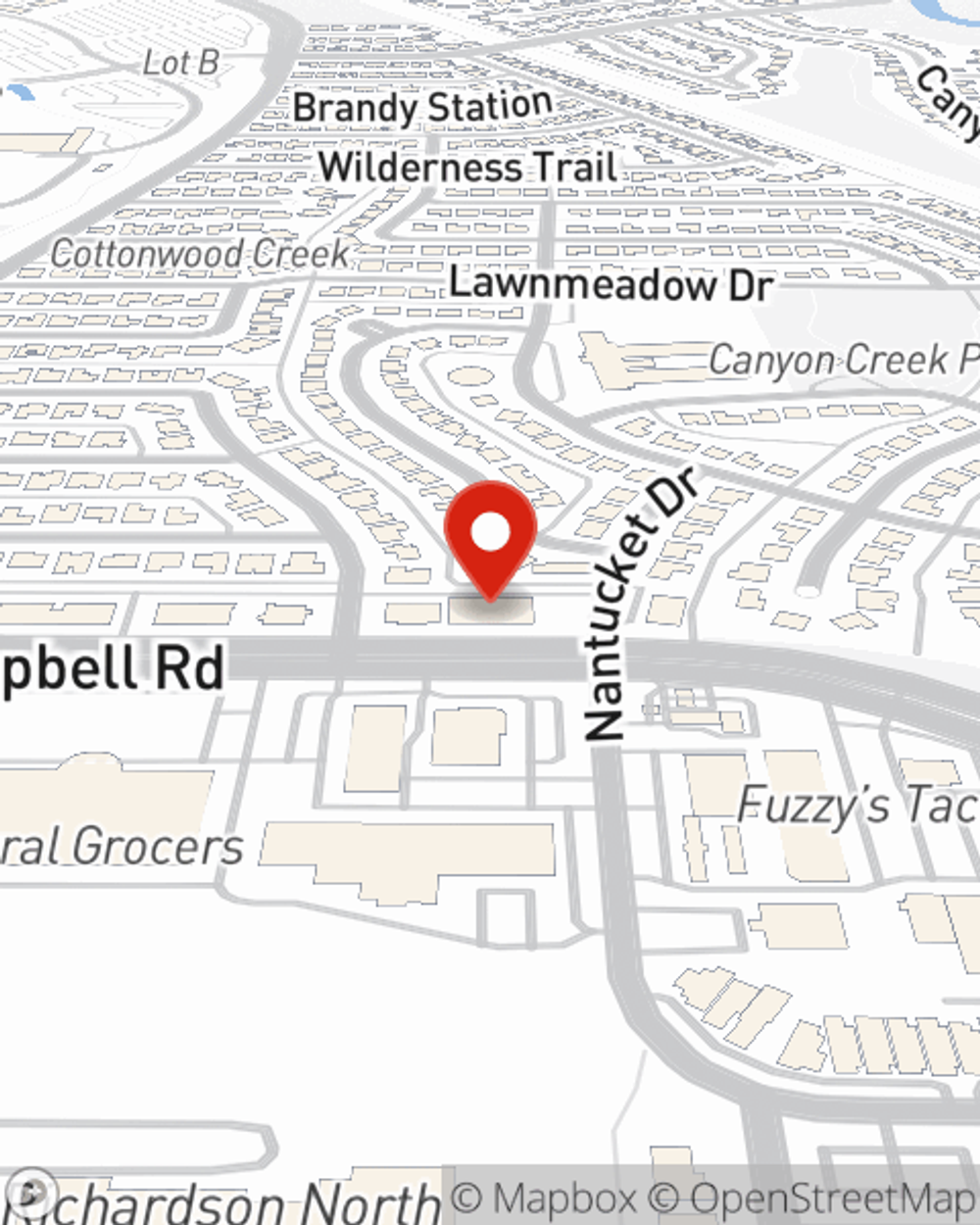

Condo Insurance in and around Richardson

Richardson! Look no further for condo insurance

Protect your condo the smart way

- Dallas

- Garland

- Lake Highlands

- Lakewood

- Highland Park

- Plano

- University Park

- North Dallas

- White Rock Lake

- Rowlett

- Rockwall

- Irving

- Grand Prairie

- Mesquite

Home Is Where Your Condo Is

The life you are building is rooted in the condo you call home. Your condo is where you laugh and play, kick back and chill out. It’s where you build a life with your favorite people.

Richardson! Look no further for condo insurance

Protect your condo the smart way

State Farm Can Insure Your Condominium, Too

That’s why you need State Farm Condo Unitowners Insurance. Agent John Jinuntuya can roll out the welcome mat to help generate a plan for your particular situation. You’ll feel right at home with Agent John Jinuntuya, with a straightforward experience to get high-quality coverage for your condo unitowners insurance needs. Personalized care and service like this is what sets State Farm apart from the rest. Agent John Jinuntuya can help you file your claim whenever bad things happen. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

Ready to move forward? Agent John Jinuntuya is also ready to help you see what customizable condo insurance options work well for you. Reach Out today!

Have More Questions About Condo Unitowners Insurance?

Call John at (214) 343-2700 or visit our FAQ page.

Simple Insights®

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

John Jinuntuya

State Farm® Insurance AgentSimple Insights®

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.